A great cardholder experience can decide whether a customer stays loyal or churns.

Capgemini Research reports that 73% of customers feel indifferent or dissatisfied with their current card experience. That kind of disengagement puts long-term loyalty at risk. According to a recent FICO survey, 88% of bank customers say customer experience matters as much as or more than products and services.

If the experience is smooth, personal and rewarding, cards earn “top of wallet” status. That means more usage, more loyalty, and more value.

Here are five ways to improve your cardholder experience:

1. Be Transparent

Clear communication matters. Cardholders want to know:

- Why a payment failed

- What fees apply

- How to fix issues themselves

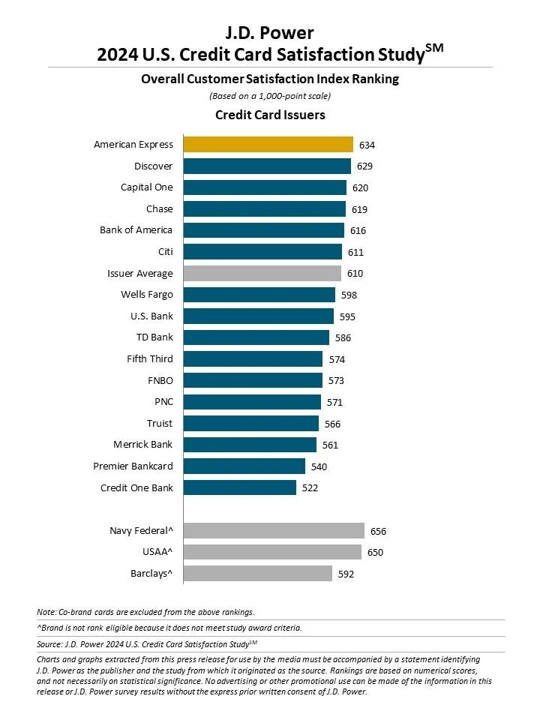

Transparency builds trust. The J.D. Power 2024 study ranks card issuers based on how customers rate their experience. The top performers lead in clarity, ease of use, and issue resolution, key factors in a strong cardholder experience.

2. Personalize the Experience

Users want cards that work for them. Personal rewards, spending alerts, and smart controls boost usage. Personalization can raise card engagement by 15–30%, according to multiple industry sources.

3. Keep It Secure-Without Adding Friction

Security is vital. But if it gets in the way, users leave. Smart fraud detection, biometrics, and smooth authentication protect users without slowing them down.

False declines and clunky checks lead to drop-off and frustration.

- Make Payments Seamless

Cardholders expect payments to work- quickly and without issues. When a transaction fails, they often blame the card, not the context. That puts your brand and customer relationship at risk. Every failed payment increases the chance of losing a customer.

To stay top-of-wallet, issuers must focus on reducing avoidable declines. Whether you offer debit or credit, there are ways to minimize friction and protect your cardholder relationships. Explore our credit card solution or see how Kipp supports debit issuers.

5. Invest in Digital Tools

Cardholders expect 24/7 access across mobile and web. That includes:

- Freezing a lost card instantly

- Seeing transactions in real-time

- Managing spending and limits easily

A strong digital experience reduces support calls and boosts satisfaction.

A New Way to Reduce Declines and Improve Loyalty

Kipp helps card issuers reduce payment declines, especially those caused by non-sufficient funds (NSF). These declines are a key source of friction and customer loss. By working with both issuers and merchants, Kipp prevents these declines and helps more payments go through. The result: fewer interruptions, more satisfied users, and stronger cardholder loyalty. Contact us to learn more.