The Platform

Innovative technology

for Issuer-Merchant collaboration

Kipp bridges the gap between issuers and merchants to unlock revenue and reduce card declined transactions.

Example: Insufficient Funds (NSF) Declines

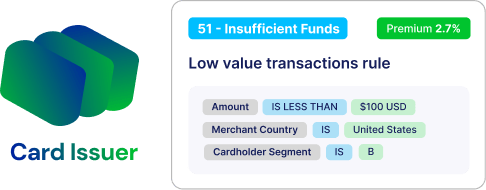

An issuer sets the rules

and ‘Ask’ price

An issuer creates customized rules to determine which transactions it’s willing to approve using a range of parameters.

Rules are based on factors like:

- Cardholder segment: credit score or affordability score.

- Over-limit amounts: How far over the limit the cardholder is.

- Merchant Category Code (MCC): The type of merchant involved.

- Any other parameter: An issuer can use any other data point

related to the transaction or cardholder.

An issuer sets an ‘Ask’ price e.g. Premium 2.7%

(a percentage premium fee) it requires the merchants to pay it for approving these transactions.

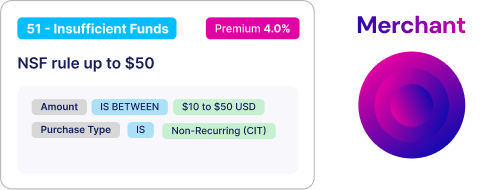

A merchant sets their

‘Bid’ price

That’s it- no API integration or sharing of sensitive data is required to avoid NSF declines!

- Shares Merchant IDs (MIDs) to identify transactions.

- Sets their Bid Price: The percentage of transaction value they are willing to pay to avoid a decline.

A merchant defines their ‘Bid’ price e.g. Premium 4.0% the percentage premium it’s willing to pay to avoid declined transactions.

Real-time collaboration

Here is how Kipp connects issuers and merchants in real-time:

- Transaction Decline Trigger:

A customer or merchant initiates a payment.

The issuer assesses the transaction and determines it would normally be declined due to insufficient funds or credit limit exceeded. - Issuer Contacts Kipp:

The issuer sends a secure API call to Kipp to check if the merchant is enrolled and their ‘Bid’ price matches the issuer’s ‘Ask’ price. - Kipp Merchant Check:

If the merchant is enrolled with Kipp and their ‘Bid’ price meets or exceeds the issuer’s ‘Ask’ price, Kipp facilitates the approval.

- Transaction Approved:

The issuer authorizes the payment, the merchant avoids a lost sale, and the customer enjoys a seamless checkout experience.